Family Auto Insurance

|

|

Throughout history, the world has witnessed devastating floods that have left lasting impacts on communities, economies, and the environment. From ancient civilizations to modern cities, floods have shaped human history and taught invaluable lessons about preparedness, resilience, and adaptation. In this blog, we'll explore some of the most significant historic floods, the lessons learned from these catastrophic events, and how they continue to inform flood risk management strategies today.

0 Comments

Floods and earthquakes are natural disasters that can cause significant damage to homes and belongings. Standard homeowners and renters insurance policies typically do not cover losses resulting from these events. To ensure comprehensive protection against flood and earthquake-related damages, separate insurance policies are necessary. In this guide, we will delve deeper into how flood and earthquake insurance work, what they cover, factors that affect premiums, and important exclusions to be aware of.

Climate change is no longer a distant concern; it's a reality we face today. As global temperatures rise and weather patterns become more erratic, the risk of flooding is increasing across the world. In this blog, we will explore the undeniable link between climate change and flooding and discuss why flood insurance is more critical than ever in protecting your home and assets.

Floods are an unfortunate and all-too-common natural disaster that can bring devastating consequences to homes and businesses. Despite being the most frequent and costly natural disasters in the United States, many individuals still lack adequate flood insurance coverage. This article aims to shed light on flood insurance, explaining what it is, who needs it, and why it's a critical component of financial preparedness in flood-prone areas.

Planning for catastrophic events like floods is not just a wise choice; it's a necessity. Floods have the potential to devastate properties, disrupt daily life, and, in the worst cases, even claim lives. Preparedness can significantly mitigate the impact of flooding, reduce the risk of injuries, and save lives. Individuals and communities are better equipped to recover from the aftermath of a flood when they are well-prepared.

One crucial aspect of flood preparedness is securing flood insurance. This article will delve into flood insurance, its coverage, and the factors influencing its cost. As a homeowner, it's important to prepare for the possibility of a flood, as it can cause significant damage to your property and finances. Here are some tips for what to do before, during, and after a flood in Detroit, specifically for flood insurance policyholders:

As a homeowner in Detroit, mitigating the risk of flood damage to your property is essential for protecting your home and finances. Here are some tips for mitigating flood risk for your property:

Flood insurance regulations and laws can be complex, and as a homeowner in Detroit, it's important to educate yourself on the regulations and laws that affect your flood insurance policy. Here are some tips for educating yourself on Detroit flood insurance regulations and laws:

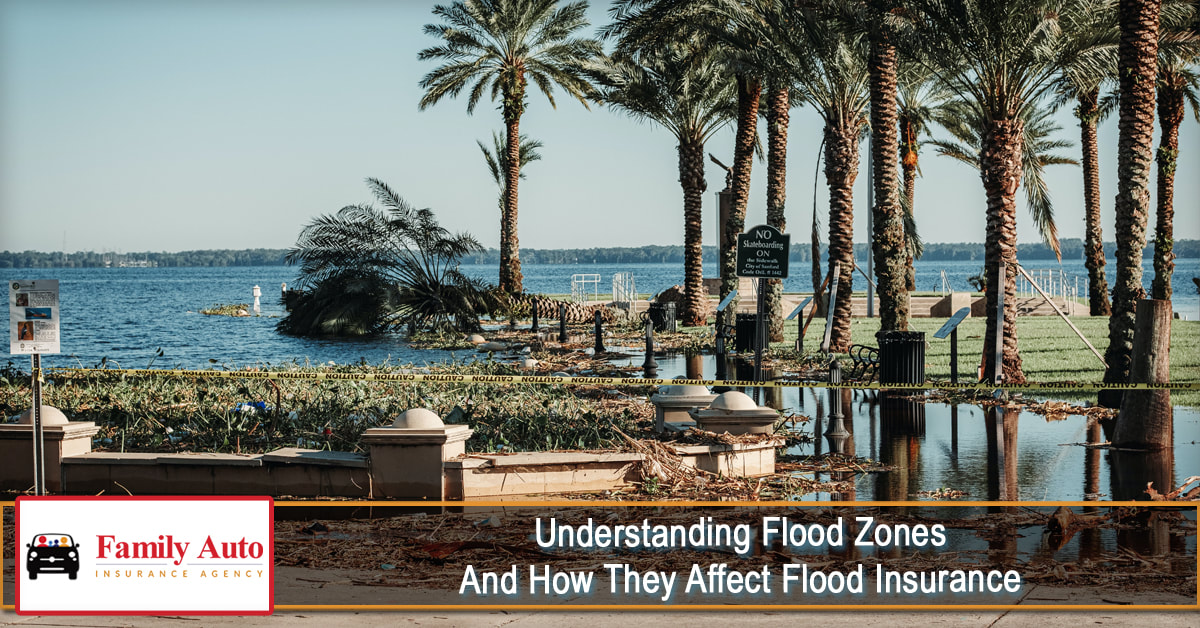

As a homeowner, it's important to understand the flood risks associated with your property and how they can impact your flood insurance policy. One key factor in determining flood risk is the flood zone in which your property is located. Here is some information on flood zones in Detroit and how they can affect flood insurance:

Flooding can be commonplace for people living near lakes or other bodies of water. When there is a flood, the risk of damage to your home, furniture, and appliances can also be high. What makes matters worse is that your homeowners' insurance will not pay the cost of flood damage. For this reason, you must buy a separate policy covering flood damage.

One excuse you might have is that you are not living in a flood-prone area. But with unpredictable weather, anything can happen, so you need to be prepared. According to the Federal Emergency Management Agency (FEMA), just an inch of floodwater can result in $25,000 worth of damage. Having flood coverage can spare you these expenses. But when getting flood insurance, you first need to understand the basics. |

Contact UsDetroit Office: Archives

June 2024

Categories

All

|

Navigation |

Connect With UsShare This Page |

Contact UsFamily Auto Insurance Agency

Detroit Office: 6442 Michigan Ave Detroit, MI 48210 (313) 285-9042 |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed